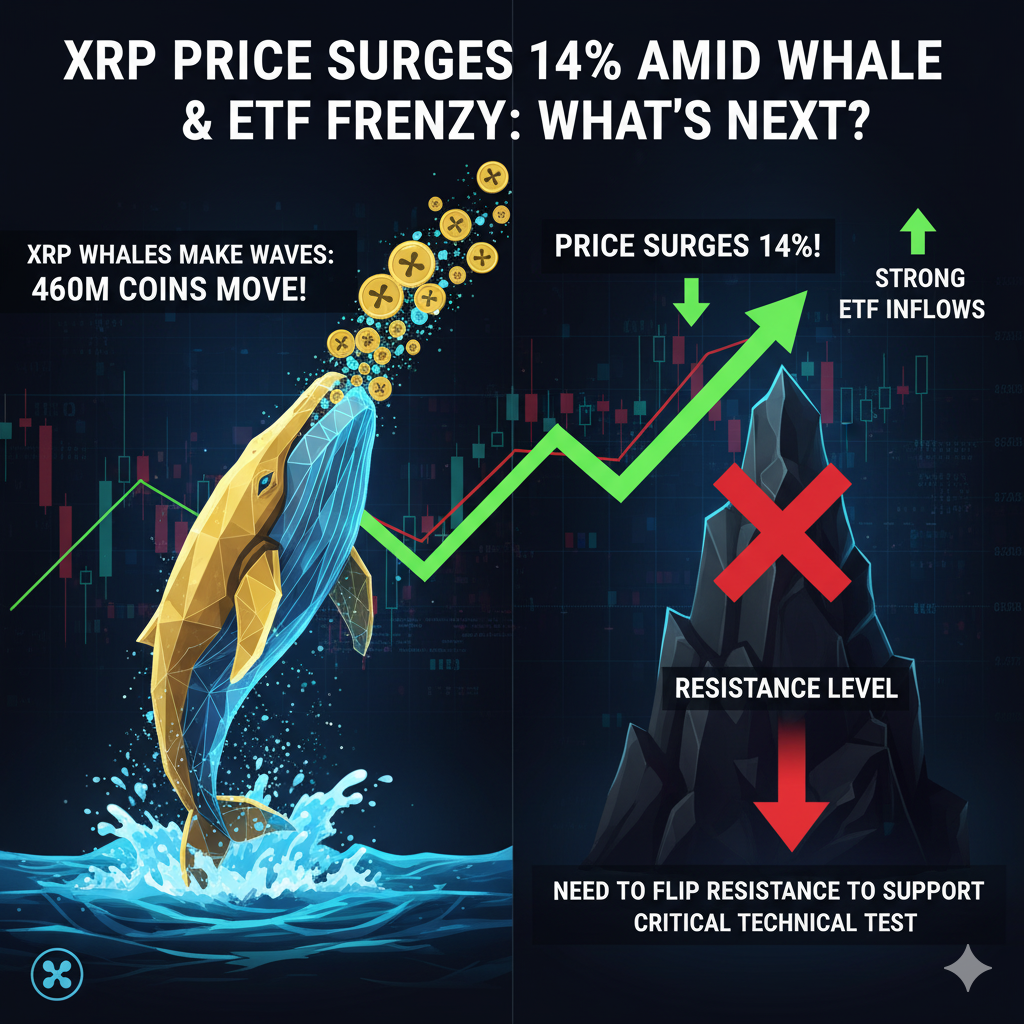

The XRP price has ignited with a impressive 14% weekly surge, catalyzing significant on-chain activity from major cryptocurrency holders. While the price momentum captured trader attention, beneath the surface a substantial 460 million XRP changed hands between whale wallets, creating a complex narrative of profit-taking and institutional accumulation.

This coordinated movement among large holders comes alongside robust institutional demand through newly launched XRP ETFs, setting the stage for a potential continuation of the bullish momentum—if key technical levels can be conquered.

Whale Watching: Major Holders Reshuffle Portfolios

Blockchain analysts, including prominent voice Ali Martinez, reported unprecedented whale activity coinciding with XRP’s price recovery. The movement of 460 million coins represents one of the most significant redistribution events in recent months, suggesting both profit-taking and strategic repositioning among major investors.

Such substantial transfers typically indicate two potential scenarios:

-

Profit-taking by early investors capitalizing on the recent price appreciation

-

Portfolio rebalancing by institutional players establishing new positions

The timing is particularly notable, as these movements occurred during XRP’s recovery from previous lows, indicating sophisticated timing among large-scale holders.

Institutional Demand: XRP ETFs Outperform Market Leaders

While whales dominated on-chain activity, traditional finance channels told a parallel story of growing institutional confidence. Data from SoSoValue reveals that XRP ETFs from major providers including Grayscale, Bitwise, and Franklin Templeton have demonstrated consistent net inflows since their launch.

The institutional appetite became particularly evident on November 26th, when XRP ETF inflows surpassed both Bitcoin and Solana ETFs on the same date. This notable achievement marks a significant vote of confidence from traditional finance, especially considering Solana ETFs recorded their first outflow on that same day.

Technical Analysis: The Battle for Key Resistance

Despite the bullish momentum, analysts caution that XRP price faces a critical technical challenge. According to market observer CRYPTOWZRD, the current resistance zone must transform into reliable support to sustain the upward trajectory.

The technical landscape presents two clear scenarios:

Bullish Breakout:

A decisive conversion of resistance into support could establish higher price targets and confirm the sustainability of the current rally. This scenario would be bolstered by continued institutional inflows and reduced selling pressure from whale distributions.

Consolidation Phase:

Failure to break through resistance could lead to a period of consolidation, allowing the market to absorb recent gains and establish a stronger foundation for the next move.

Market Outlook: Balancing Whale Activity with Institutional Flows

The current XRP price action represents a tension between two powerful market forces:

-

Whale distribution creating potential selling pressure

-

Institutional accumulation through ETFs providing consistent demand

Market participants are closely monitoring these competing dynamics for clues about XRP’s next significant move. The substantial whale movements suggest volatility may continue in the near term, while sustained ETF inflows provide a bullish counterbalance for medium-term prospects.

As with all cryptocurrency investments, traders should watch for confirmation of key technical levels alongside continued institutional participation to gauge the longevity of the current bullish momentum.