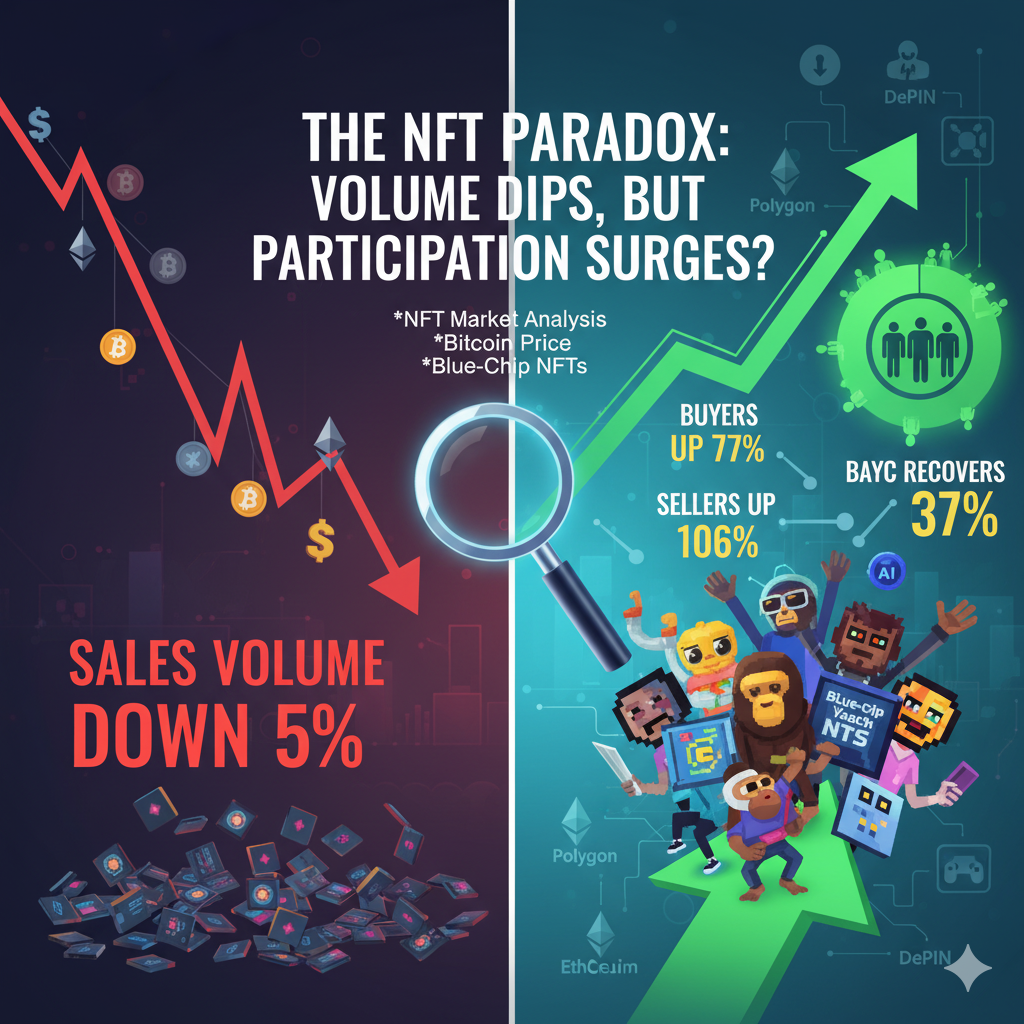

The latest NFT market analysis reveals a fascinating dichotomy: while overall NFT sales volume has experienced a notable dip, the number of participants engaging in the space has skyrocketed. This intriguing trend unfolds against a backdrop of broader cryptocurrency market weakness, with Bitcoin price retreating from its highs and Ethereum facing its own challenges. Let’s delve into the data to understand this evolving landscape.

A Closer Look at the Numbers: Softening Sales, Exploding Engagement

According to recent CryptoSlam data, the aggregate NFT sales volume for the past week settled at $72.53 million, marking a nearly 5% decline from the previous week’s $79.31 million. This reduction in transaction value, coupled with a 12.67% decrease in total NFT transactions, might initially suggest a cooling market.

However, a deeper dive into market participation metrics paints a remarkably different picture:

-

Buyers surged by over 77%, bringing the total to more than 293,000 individuals entering the NFT market.

-

Sellers jumped an impressive 106%, with over 284,000 participants looking to offload digital assets.

This simultaneous increase in both buyers and sellers, despite lower overall volume, indicates a significant expansion of the market’s user base. More people are actively engaging with NFTs, even if the average transaction value has decreased.

Macro Crypto Headwinds: Impact on Digital Collectibles

The broader cryptocurrency market has undoubtedly played a role in the softening NFT sales. The Bitcoin price experienced a notable correction, falling to the $84,000 level, while Ethereum dipped below the $2,800 mark. The global crypto market capitalization also saw a substantial reduction, plummeting from $3.26 trillion to $2.87 trillion. Such macro shifts typically lead to a more cautious environment for risk assets like NFTs, prompting some investors to take profits or re-evaluate their positions.

Blue-Chip NFTs Show Resilience and Surprises

Despite the overall market downturn, several blue-chip NFTs and other prominent collections demonstrated varying degrees of resilience and intriguing movements:

-

Algebra Positions NFT-V2 (Ethereum) maintained its top spot in sales, though it also saw a 7.09% decline to $7.26 million.

-

DMarket (Mythos blockchain) held steady, with sales virtually flat at $6.67 million. Notably, it processed a massive volume of transactions and attracted a significant number of buyers and sellers, showcasing high activity.

-

Courtyard (Polygon) made a substantial leap, surging over 32% to $2.97 million, indicating growing interest in specific collections outside the dominant Ethereum ecosystem.

-

Pudgy Penguins (Ethereum) saw a marginal increase in sales, securing its position among the top performers.

-

CryptoPunks (Ethereum) not only climbed in rankings with a 12.57% increase to $2.32 million but also dominated the top individual sales, with five of its NFTs selling for over $100,000 each.

-

Bored Ape Yacht Club (BAYC) staged a remarkable comeback, surging over 37% to $1.98 million. This significant recovery for one of the most iconic blue-chip NFTs suggests renewed confidence or strategic buying within the collection.

Blockchain Performance: Ethereum Leads, BNB Chain and Polygon See Growth

Ethereum continues to dominate the NFT landscape in terms of sales volume, registering $31.08 million despite a 6% dip. It also saw a healthy increase in buyers.

Intriguingly, other blockchains demonstrated robust growth in user participation:

-

BNB Chain experienced a 6.24% increase in sales to $9.22 million and a staggering 160% surge in buyers.

-

Polygon saw its sales volume jump by over 21% to $4.02 million, with an incredible 175% increase in buyers. This highlights the growing appeal of alternative chains offering lower transaction costs and faster speeds.

-

Mythos Chain and Bitcoin also saw substantial increases in buyer numbers, reinforcing the theme of expanding market access and participation across various ecosystems.

-

Solana, however, faced a significant downturn in sales, plummeting over 41%, despite also seeing a strong increase in buyers. This divergence suggests price sensitivity or a shift in focus for some participants on that chain.

The Emerging Narrative: A Maturing Market?

The current NFT market analysis paints a picture of a sector undergoing a subtle but significant transformation. The dip in overall sales volume, influenced by the broader crypto market, might be seen as a healthy correction or consolidation phase. However, the dramatic increase in new buyers and sellers suggests that the NFT space is not shrinking; rather, it’s democratizing. More individuals are entering the market, potentially drawn by lower entry points or a growing understanding of digital ownership.

This paradox — lower volume but higher participation — could indicate a maturing market where speculative froth is being tempered by genuine interest and utility. While the volatility of high-value sales remains, the expanding user base points towards a future where NFTs are integrated into a wider array of digital experiences and communities. For investors, monitoring the underlying strength of communities, technological advancements on various blockchains, and the evolving utility of digital assets will be crucial in navigating this dynamic environment.