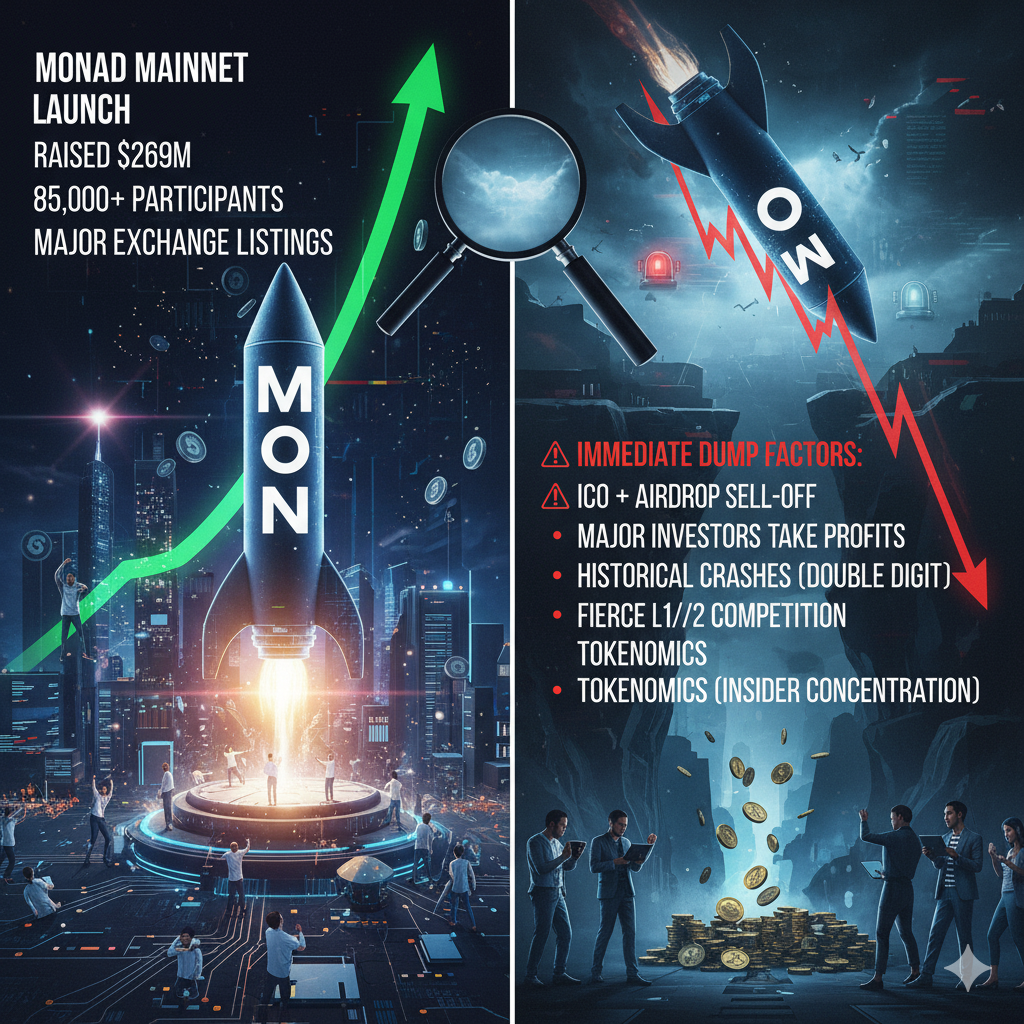

The spotlight turns to Monad (MON) this week as the fast-growing Layer-1 blockchain prepares to activate its long-awaited mainnet following a record-breaking token sale. The project secured $269 million in funding during its ICO hosted by Coinbase—making it one of the most successful token offerings of 2025.

More than 85,000 participants joined the event, pushing the sale to become 1.43× oversubscribed, a clear sign of strong early momentum.

Major Exchange Listings Arrive Monday

The next phase of the project’s rollout begins Monday, when Monad officially launches its mainnet and lists the MON token on major exchanges, including Coinbase and Bybit.

This debut will open the doors for ICO participants, early investors, and insiders to finally unlock liquidity, while also giving new buyers the opportunity to enter before the ecosystem matures.

Why Investors Are Watching MON Closely

Supporters argue that Monad has the potential to become a disruptive force in the Layer-1 market. The network boasts:

-

EVM compatibility

-

High throughput and low latency

-

200+ validators

-

Integrations with major ecosystem players such as LayerZero, Pyth Network, and Chainlink

Because of these strengths, long-term holders view MON as a promising asset capable of competing with more established chains.

Could MON Dump After Its Exchange Listing?

Despite the excitement, several market factors indicate that MON may face immediate downside after launch.

1. ICO + Airdrop Sell-Off Pressure

Historically, tokens released after large airdrops or ICOs experience sharp price declines as investors rush to secure profits.

Examples include LayerZero, Pi Network, and several new tokens released this year.

2. Major Investors May Take Profits

Early backers such as Paradigm, Electric Capital, Dragonfly, and Castle Island are sitting on major paper gains.

The MON listing offers an ideal exit window—meaning sell pressure may spike quickly.

3. Newly Launched Tokens Often Drop Double Digits

A recent trend shows many high-profile launches—such as World Liberty Financial, Trump Coin, Somnia, Wormhole, and Keeta—suffer immediate double-digit declines.

4. Fierce Competition in Layer-1 & Layer-2

Monad enters a crowded arena dominated by:

-

Ethereum

-

Solana

-

BNB Chain

-

Additional chains from Circle, Robinhood, and others incoming

This raises the bar for long-term adoption.

5. Tokenomics Could Pressure Price

Over 50% of MON supply is controlled by insiders and the team, while only ~8% went to the public sale.

Such concentration may heighten concerns of an early-stage dump.

Final Takeaway

Monad’s mainnet launch and MON token listing are set to be some of the biggest events in the crypto space this week. While the project’s technology and early investors show strong conviction, historical patterns and tokenomics suggest that short-term volatility—and possibly a significant correction—may follow the debut.

Long-term potential remains, but traders should prepare for turbulence.