The cryptocurrency market is experiencing a notable downturn today, with Bitcoin and most major altcoins trading in the red. The global crypto market cap has fallen by 2.45%, settling around $2.95 trillion. This drop follows a period of consolidation and comes amid shifting macroeconomic signals and technical bearish patterns.

Bitcoin Leads the Slide

Bitcoin has declined by over 2%, trading near $87,300, while several altcoins have posted even steeper losses. Solana, Cardano, Chainlink, and Zcash all dropped more than 3%, reflecting broad-based weakness across the crypto sector. Many of these assets remain entrenched in bearish trends, with investors exercising caution ahead of the holiday season.

Why Is the Crypto Market Crashing?

1. Strong US Economic Data Dampens Rate Cut Hopes

The latest US GDP figures showed the economy growing at an annualized rate of 4.3% in Q3, surpassing expectations of 3.3%. This robust growth—driven partly by sustained data center spending—along with rising industrial output in November, suggests the Federal Reserve may delay interest rate cuts. Historically, cryptocurrencies tend to perform better in a lower-rate environment, so the prospect of prolonged higher rates has weighed on sentiment.

2. Low Liquidity and Investor Caution Ahead of Christmas

Trading activity has slowed as participants reduce exposure before the holidays. Futures open interest dropped 1.5% to $128 billion, while spot market volume fell to around $100 billion. This decline in liquidity can amplify price swings and contribute to downward pressure.

3. Safe-Haven Assets Gain Favor

Investors are increasingly shifting toward perceived safe havens like gold and the Swiss franc, signaling a rise in risk aversion. Some institutional players, including major investment firms, have begun moving portions of their portfolios to cash, reflecting concerns about near-term market stability.

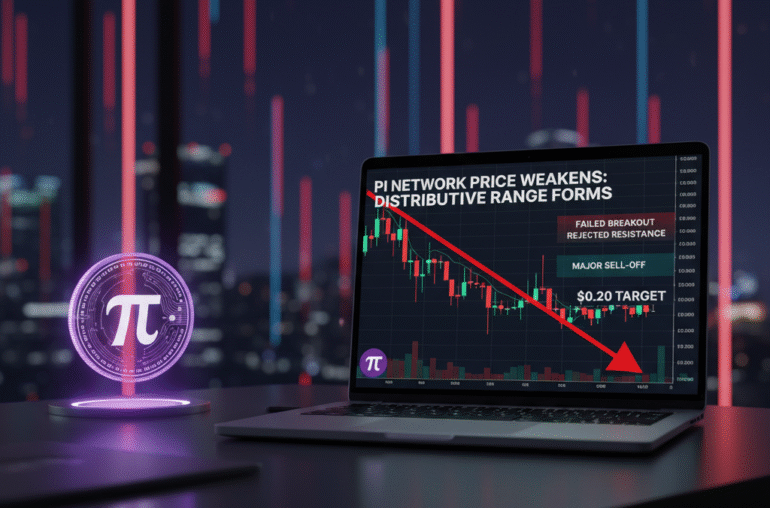

4. Bearish Technical Patterns Emerge

Bitcoin and Ethereum have formed concerning chart patterns on daily and weekly timeframes. Bitcoin is currently tracing a bearish pennant—a continuation pattern that often precedes further declines. Additionally, Bitcoin recently formed a death cross, where the 50-day moving average crosses below the 200-day moving average, and it has broken below the Supertrend indicator. These signals suggest the potential for more downside in the near term.

What Comes Next for Crypto?

If Bitcoin breaks below the pennant pattern, it could trigger another leg down, potentially dragging altcoins lower with it. Traders are closely watching key support levels, while the broader market awaits clearer signals from macroeconomic policy and institutional flows.

For now, caution prevails as the crypto market navigates a mix of technical headwinds and shifting macro expectations.